Sampling and Assaying

A prospector sometimes fails to reap the full advantage, or even any advantage, from a discovery, because of his manner of handling it. The first step is to ascertain the value of the mineral deposit; in most cases, this must be done by having assays made. As a preliminary, a selected sample of the best looking material may be sent to the assayer, the object being to find out if the discovery is of any value; but if the result of this assay be favorable, no more assaying should be done with specially selected samples. Samples should correctly represent the entire body of ore, and it is a waste of time and money to have selected pieces assayed.

Channeled Samples

Channeled samples should be taken when possible. This is done by cutting a channel across the ore body, about 2 inches wide and ½ inch deep, using a sharp-pointed steel tool, called a moil. A tarpaulin or a piece of canvas (oilcloth is best) should be kept spread out, so as to catch the flying chips. The whole sample so made is then crushed with mortar and pestle, thoroughly mixed, spread out on the cloth, divided into quarters, and the diagonally opposite quarters are taken out and crushed finer; this operation of crushing and quartering is repeatedly performed, until the sample is reduced to a size that is convenient to send to the assayer. The samples should be marked with a number, and a record kept concerning them. A duplicate sample should be retained, in the case it be desired to have the assay repeated. When the valuable mineral is mostly invisible, as in the case of gold-bearing quartz, assays of many samples are required thoroughly to test the value of the discovery.

On the other hand, the mineral may, perhaps, be easily seen and its quantity judged, and assays to determine the richness of the ore may, at first, be unnecessary. For instance, a discovery of galena can often be judged quite closely by the eye, as to the proportion of ore to rock. The first thing to find out through assays of the galena is the number of ounces of silver in a ton of the ore; this will show whether the ore is simply lead or silver-lead ore. Again, if iron ore is discovered, its richness can be fairly well judged by its weight; but its freedom from sulphur, phosphorus and other objectionable impurities must be determined by the chemist.

Duplicate Samples

Prospectors sometimes do injustice to assayers by sending samples as duplicates that are not really such. Two pieces of ore obtained by breaking from a larger piece are not necessarily of the same value; pieces of gold ore that look exactly alike may have different values in gold. In fact, samples are not really duplicates unless prepared properly.

Development of a Discovery

Whenever a discovery of valuable mineral has been made, surface development should be carried on to as great an extent as is possible. It is easier and cheaper to get information in this way about the extent and value of the ore body, than to get it by sinking a shaft. The vein, or other ore body, should be stripped as far as it can be followed. Where the overburden is too deep for such work, cross trenches at intervals may be practicable; and other veins may be discovered while trenching. It can be assumed as a general rule, to which, however, there are exceptions, that the ore body will show the same variations in size and values along the surface that will be found when going down through it. There are cases where a vein shows only its apex at the surface, sometimes as a mere thread of quartz or other gangue, which expands from the surface down. In other cases, the discovery may be the opposite of this, the bottom or root of an ore body that pinches out at a small depth. Even in these cases, the chances of getting reliable information by stripping or trenching are good. A safe method of procedure is to strip, trench, sample, and assay. Test pits may be sunk, to show what the ore is like below the action of weathering; but generally, the sinking of a shaft should be left to the mining investor or to the mining company. By surface work, the prospector puts his property in condition for examination by an engineer; and it should be remembered that the engineer has no greater ability to see through the overburden than the prospector has. It is the prospector’s work not only to discover valuable minerals but also to prepare the surface of his property for examination by the engineer.

Prospecting in Canada

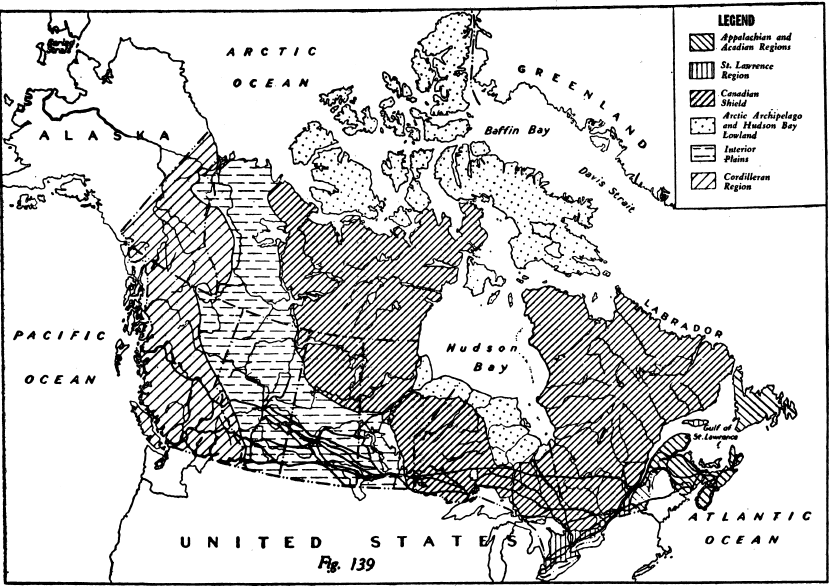

The accompanying map shows Canada divided into six parts that may be called mineral provinces, as follows:

- the Canadian Shield, including, the greater part of Quebec, Ontario, and Manitoba, the northern third of Saskatchewan, the northeast corner of Alberta, and all the territory from the northern boundaries of Manitoba and Saskatchewan to the Arctic Ocean;

- the Appalachian and Acadian Region, covering the Maritime provinces (including Newfoundland) and the south side of the lower St. Lawrence valley to the end of the Gaspé peninsula;

- The St. Lawrence Region, including the upper St. Lawrence valley and westward to Lake Huron;

- Arctic Archipelago and Hudson Bay Lowlands;

- the Interior Plains, covering large parts of Manitoba and Saskatchewan, most of Alberta, a corner of British Columbia, and a broad strip of the northwest territories east of Yukon;

- the Cordilleran Region, including a small part of Alberta and most of British Columbia and Yukon.

Of these divisions, the Canadian Shield is the largest; it contains the greatest area of good prospecting territory on the continent. With the exception of the part within it called Hudson Bay Lowlands, it is all pre-Cambrian, and there is no apparent reason why the great unexplored spaces in the north should not turn out to be as productive as the comparatively small explored areas in Manitoba, Ontario and Quebec, in which have been found a great variety of valuable minerals, including ores of iron, gold, silver, copper, lead, zinc, nickel, cobalt, arsenic, molybdenum, tungsten, beryllium, titanium, vanadium, uranium, the platinum metals, and also most of the non-metallic minerals of value.

The Appalachian and Acadian division is also probably pre-Cambrian over the greater part of Newfoundland and Nova Scotia and smaller parts of New Brunswick and Southeastern Quebec. The famous Wabana hematite ore beds contain fossíls and are Ordovician in age. In Nova Scotia and New Brunswick, rocks of Carboniferous age provide extensive coal areas, as well as gypsum, salt, Petroleum, natural gas, and oil shale. In Devonian and earlier Paleozoic times there were extensive intrusions of granite in Nova Scotia, New Brunswick, and southeastern Quebec, and these gave rise to deposits of gold, copper, iron, lead and zinc, antimony, and tungsten ores. The asbestos and chromite mines of southeastern Quebec are well known. It is likely that modern prospecting methods will make the Acadian and Appalachian region much more productive in minerals than it is at present. This is clearly indicated by the discovery, with the help of aerial surveys, of the important zinc-lead-copper deposits in the Bathurst and Newcastle areas of New Brunswick.

The rocks of the St. Lawrence region have not passed through the disturbances of extensive folding and igneous intrusion that bring ore deposits of the metallic kind, Gypsum, salt, petroleum, and natural gas have been produced in the western part of the region. A possibility in the eastern part, along the St. Lawrence, is deposits of zinc blende like those of Missouri.

The Cordilleran region is in contrast with the Canadian shield, being a comparatively young mountainous country in which erosion has gone far enough to expose mineral deposits of the metallic kind, but which has left large areas of sedimentary rocks, with vast stores of coal. British Columbia is already producing a large part of the world’s copper, gold, silver, lead, and zinc. Platinum has been found in placer deposits. Mercury has been produced from deposits near Kamloops Lake. Iron ore is plentiful in many parts of the region. Ores of antimony, arsenic, chromium, manganese, molybdenum, and tungsten have been found, and some of them worked. The non-metallic minerals are also well represented in this region. Its large extent and the great variety of its valuable minerals, make the Cordilleran region very attractive to the prospector. Much of the northern part has not been even superficially prospected.

The Interior plains, with their comparatively young undisturbed rocks, offer no attractions to the prospector who searches for metallic deposits. Coal, natural gas, petroleum, gypsum, magnesium sulphate, and sodium sulphate, are the chief mineral products.

The Arctic archipelago and Hudson Bay lowlands form a region in large part geologically like the St. Lawrence region, with its Paleozoic rocks lying almost horizontally. But pre-Cambrian areas are to be seen as extensions of the Canadian shield northward to some of the islands. Beds of bituminous coal have been found in the Carboniferous rocks of Parry Islands. Gypsum deposits are known along the Moose River. The Paleozoic rocks of the Hudson Bay lowlands and some of the Arctic islands may yield petroleum and natural gas.

Financing for Prospectors

The advance of mineral industries depends primarily upon the prospector. Unless he carries on his work and finds new mineral deposits to replace those that are worked out, the industry will languish: the financing of prospecting is therefore very important. It is at the same time a very difficult business to plan in a way that will be fair and effective. The nature of the work in such as to acquire sustained enthusiasm in addition to the necessary knowledge and experience. To maintain this enthusiasm, the prospector must feel that he will be well rewarded for any discovery he may make. That is why so many prospectors work independently, but not many can afford to do this. “Grubstaking” makes the prospector a partner with the man who grubstakes him, that is, advances him enough money to buy “grub” and pay other expenses. A good deal of our prospecting is done in this way. But a little reflection shows that the arrangement is not fair to the prospector, and is not a good investment for his grubstaker. It leaves nothing for the prospector to live upon during the winter months, when prospecting is mostly not practicable in our climate; and much less does it provide for the support of a family. There is always the hope that a discovery will be made the first summer. The grubstaker is likely to weaken, if this does not occur, and then the prospector must hunt up another backer. The arrangement is not business-like — it is too much like a game of chance. Now the fact must be faced that the element of chance is at least as powerful in prospecting as in any other business, probably more so. A very small fraction of the rocky surface of the earth is uncovered to the view. The mineral treasures would likely be found to be plentifully distributed, if we could see the whole rock surface. Failing this, the prospector has to depend upon the few outcrops of rock that he can find, on shallow places in the overburden that he can easily scrape or dig off, and on such happy accidents as are described in Art. 380. To reduce the element of chance as much as possible, the investor in prospecting should invest systematically over a long period, either by partnership with an experienced, trustworthy prospector or by becoming a member of a syndicate organized on a fairly permanent basis. In either case, the prospector should be a partner, receiving not only a share in discoveries that are saleable but also enough wages to support him and his family. In a country like Canada, with such widespread fields for prospecting, the syndicate plan for financing the prospector is capable of large development. It has the advantages:

- of distributing the expenses over a large number of investors; and

- of bringing returns to the many.

Mineral deposits should be looked upon as natural capital. It is to our advantage to keep in Canada as large a part as possible of the proceeds from this capital, and to secure for the proceeds a wide distribution. To finance prospecting by syndicates secures a large number of small investors, and, at the same time, distributes to a large number the results of fortunate discoveries.

Exploration Companies

Most of the mining companies that are operating well-established mines have now adopted the plan of sending out prospectors as a means of making discoveries that will provide a new mine when the old one is worked out. These prospectors are well paid and usually have a small share interest in any discovery they make. In the winter they can work in the company’s mine or mill, if there is no prospect to develop. In addition there are many mining companies, promoted to operate deposits that turned out poorly, that have sufficient capital left to employ a prospector to find a mine for them. They often make good employers for the prospector. There are also some exploration companies formed expressly for the purpose of prospecting and developing properties, and these are good employers. Thus the prospector who is inclined to look for a little more financial security than the freelance prospector can often find what he wants with one or another of the mining companies of these various kinds.

In conclusion, it might be emphasized that prospecting is a good life for a man in good health, particularly for a young man. When done skilfully, there is no particular hardship in the life. It requires, above all, the spirit of adventure. It is no life for the faint-hearted, or the laggard, or the man with a dependent spirit.

Canadian prospectors have earned an enviable reputation for their skill, their honesty, and the splendid results they have attained. Their character probably comes mainly from the families into which they were born; but their skill and the mines they have helped establish come largely from the time they spend in studying minerals, rocks, and little books such as this.