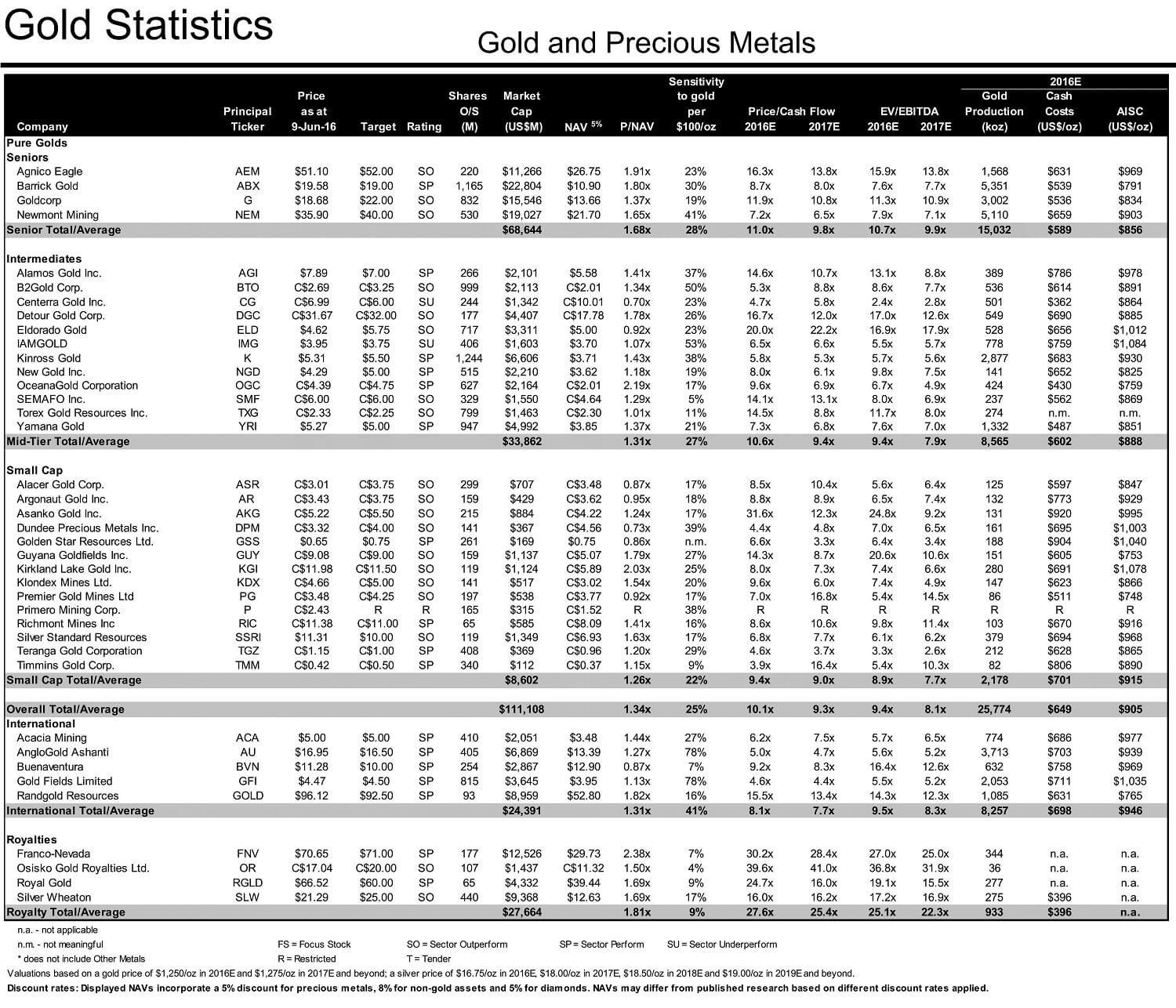

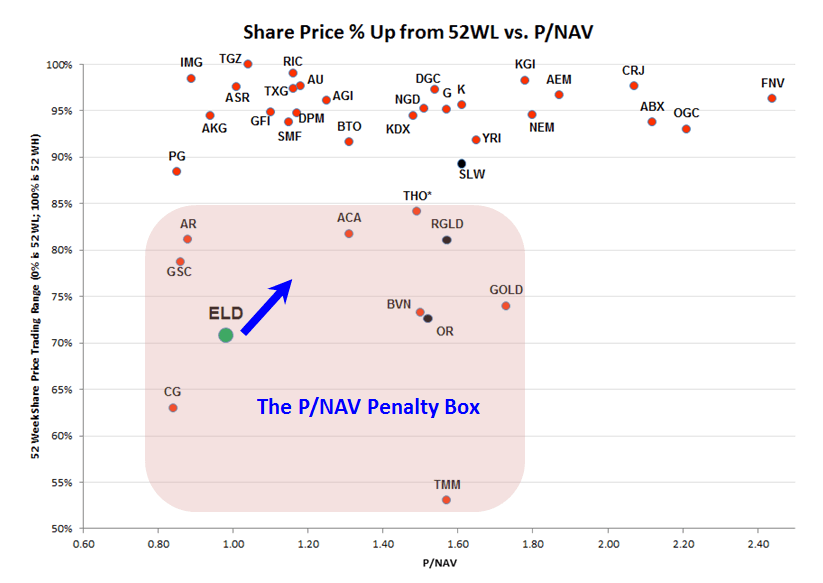

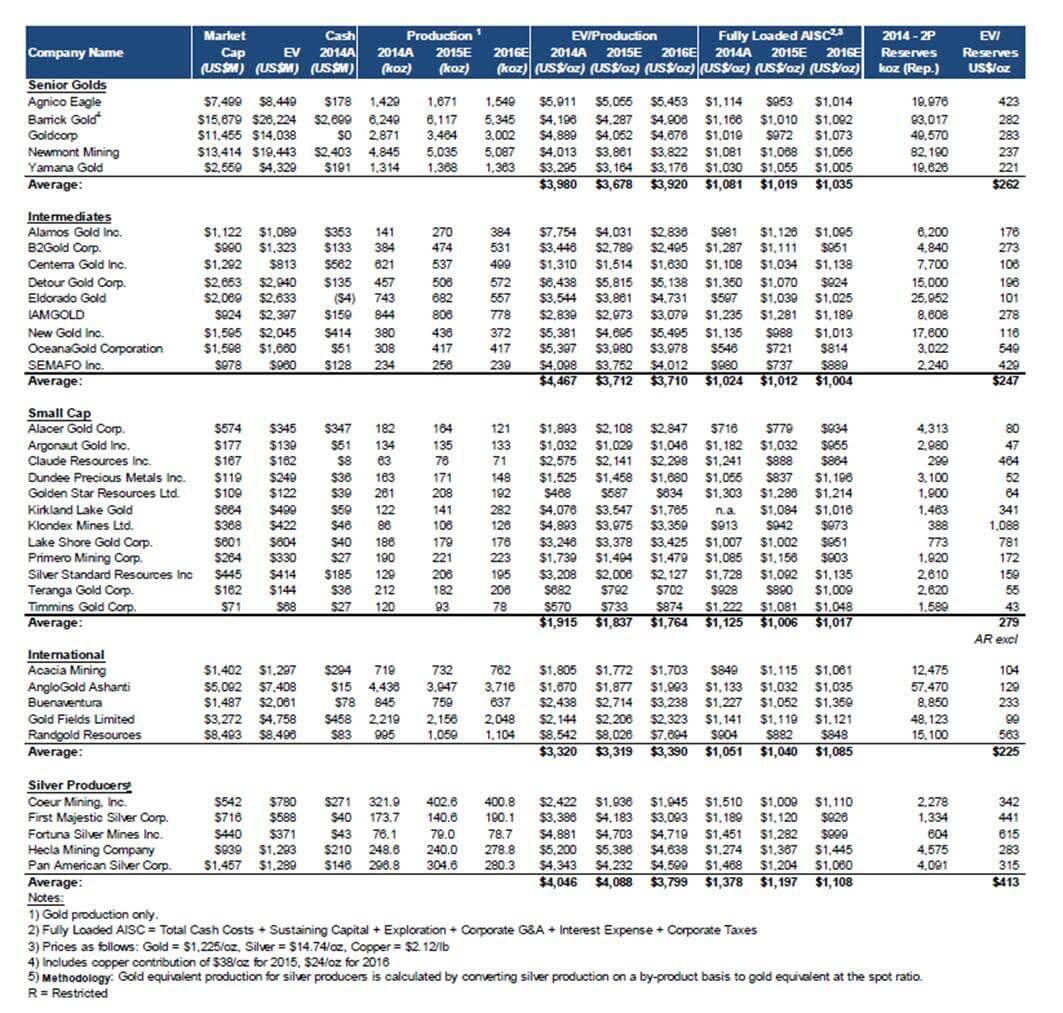

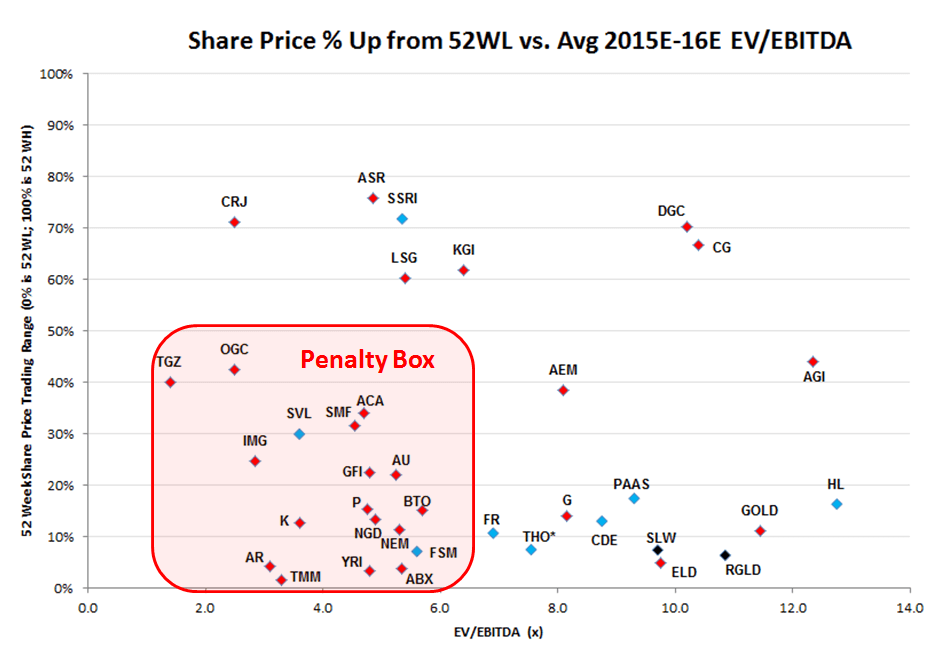

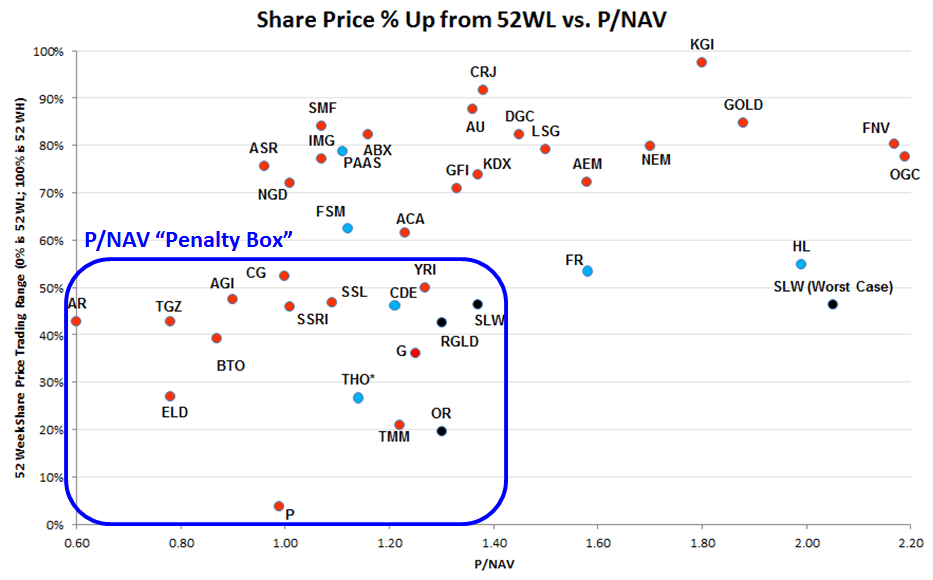

Some of the Best & Most Undervalued Gold Mining Stocks can be defined for having low or cheap valuations coupled with poor trading performance in being closer to its 52 Week Low. The share price performance, where a company trades between their 52 WH and 52 WL, of the precious metals (gold and silver) universe is here plotted versus the P/NAV and 2015 & 2016 Blended EV/EBITDA (assuming $1175 gold for 2015E and $1200 forever after). If you are looking for some of the Most Undervalued Gold Mining Stock to buy – then have a look at within the Penalty Box below.

The share price performance, where a company trades between their 52 WH and 52 WL, of the precious metals (gold and silver) universe is here plotted versus the P/NAV and 2015 & 2016 Blended EV/EBITDA (assuming $1175 gold for 2015E and $1200 forever after). If you are looking for some of the Most Undervalued Gold Mining Stock to buy – then have a look at within the Penalty Box below.

_______________________________________________________________________

Our latest detector review: Best cheap metal detector

Green = Identified “Quality” Laggard

Subsector Black = Group Average

100% = 52 Week Highs

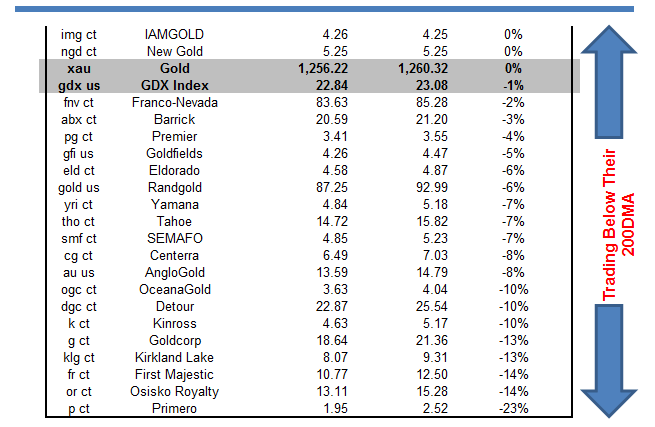

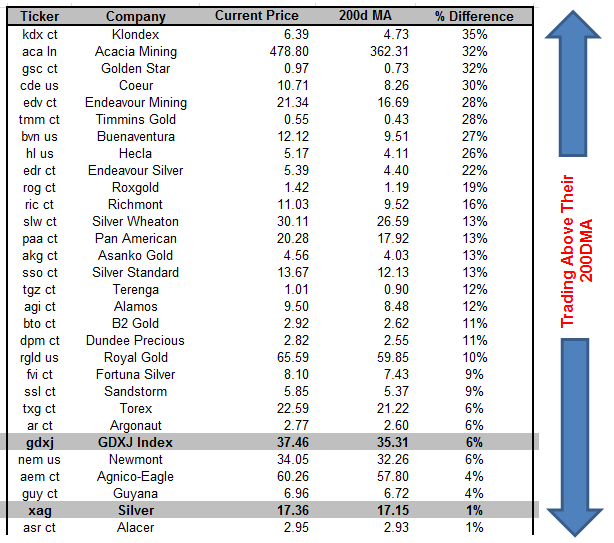

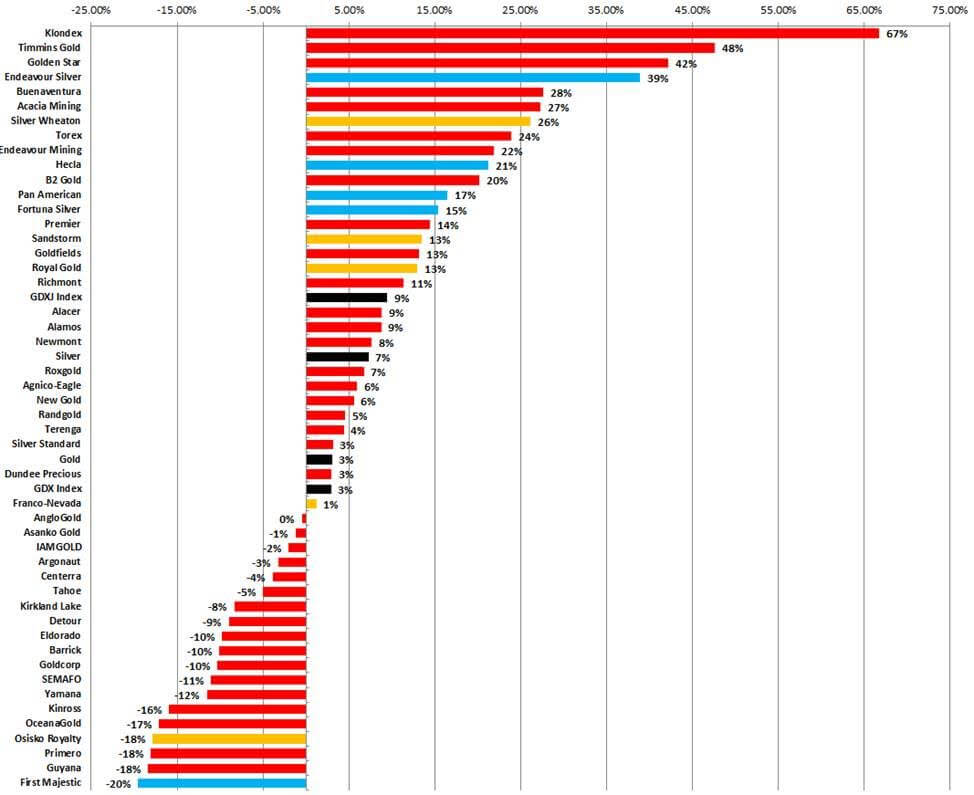

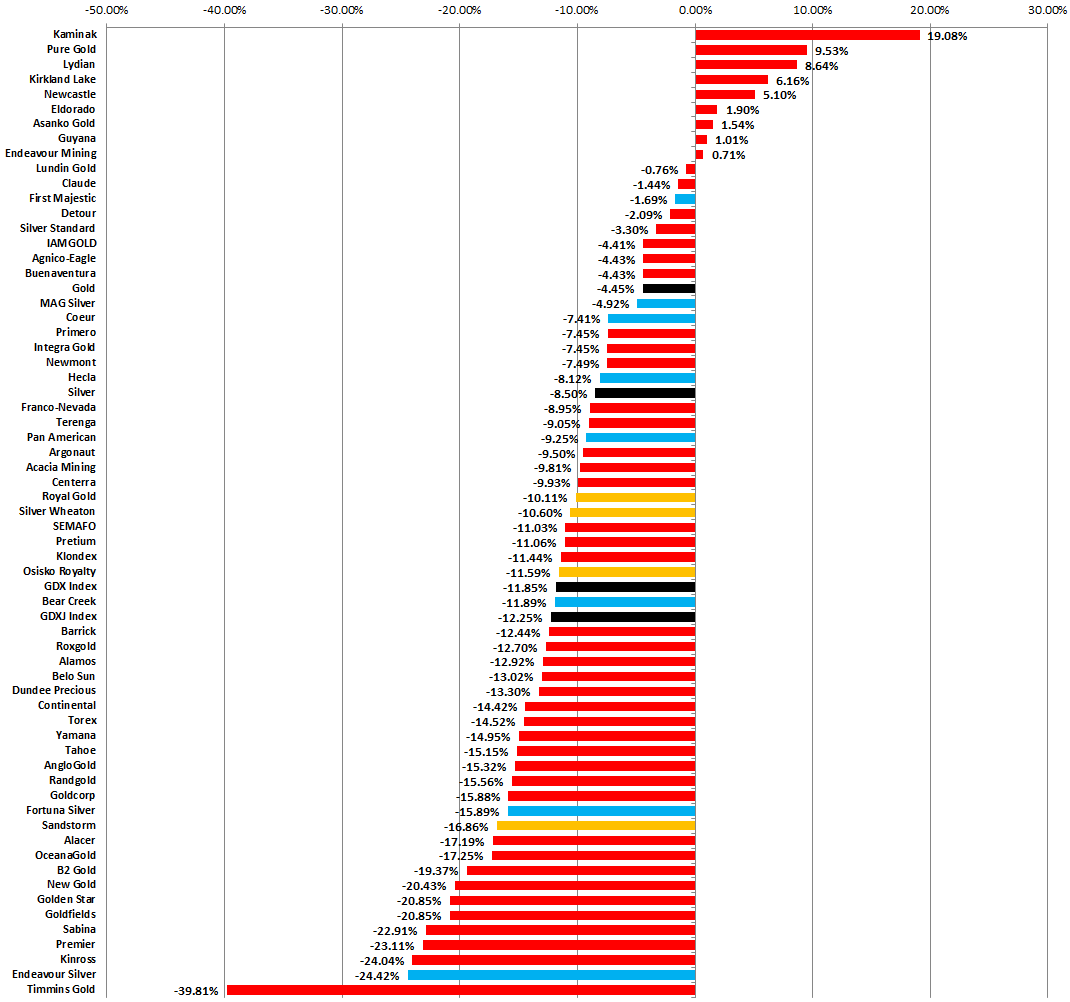

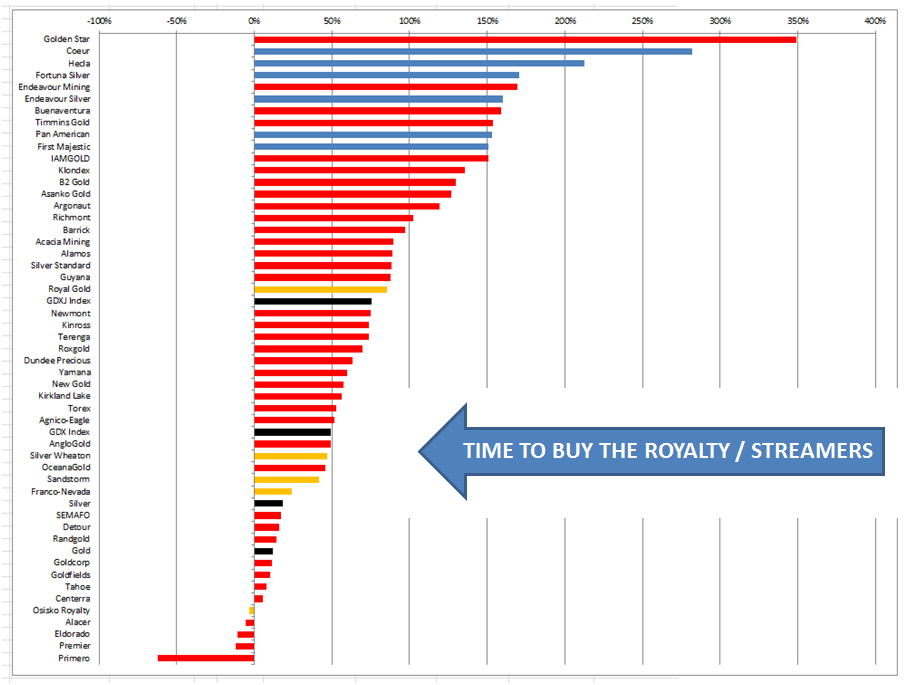

After rallying in the first four months of the year, gold had a May to forget. You could chalk it up to seasonality, but it seemed as if the fear of an impending US rate hike in June (July) put the fear back into the gold sector as it nothing but slip down over the course of the month. Well this morning’s extremely light NFP number of 38,000 (est. 160,000) will likely certainly put an end into the thought that Yellen would make move in June (although July could still be “not off the table”). So Scotia Mining Sales decided to look at the gold equity universe to see which names were the major underperformers as gold marched down in April. With gold up almost US$30.00/oz this morning, we think it is likely that those names that were hardest hit in May could likely see a rebound today and likely continuing into next week! Notable quality names at the bottom of the list include Goldcorp, Kinross, B2Gold, OceanaGold, Alacer Premier Gold and Sandstorm are best.

911Met OFF THE LIST SPECIAL –> ANX – ANACONDA MINING INC. https://www.anacondamining.com/

Graphical List Cheapest Gold Mining Company Stocks As of March 10th 2016

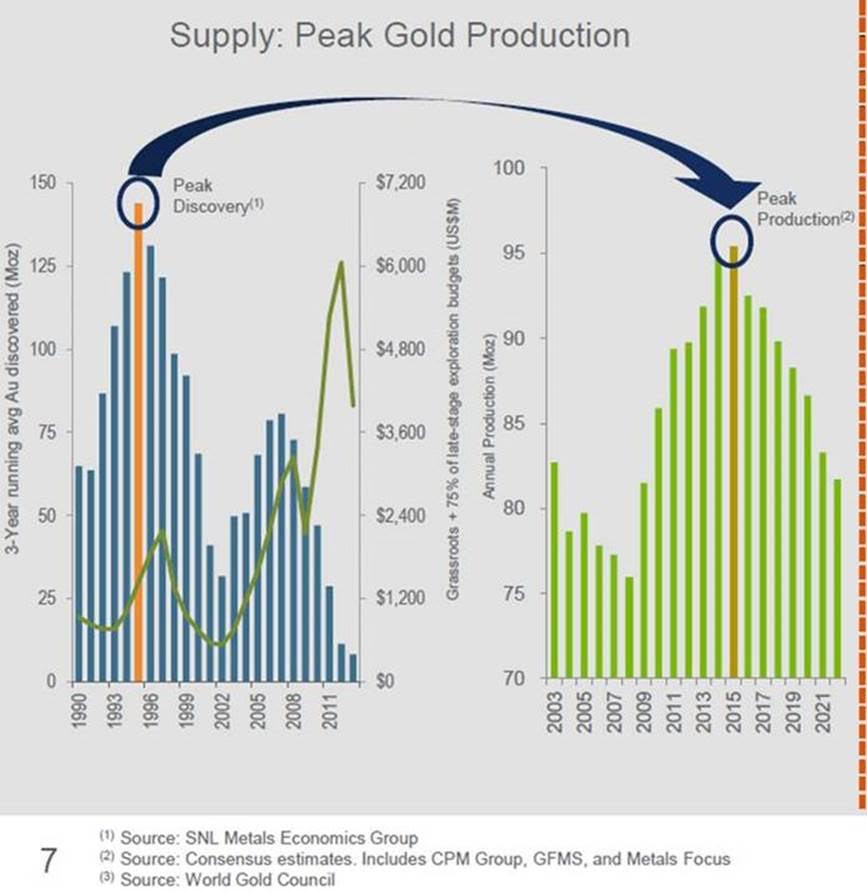

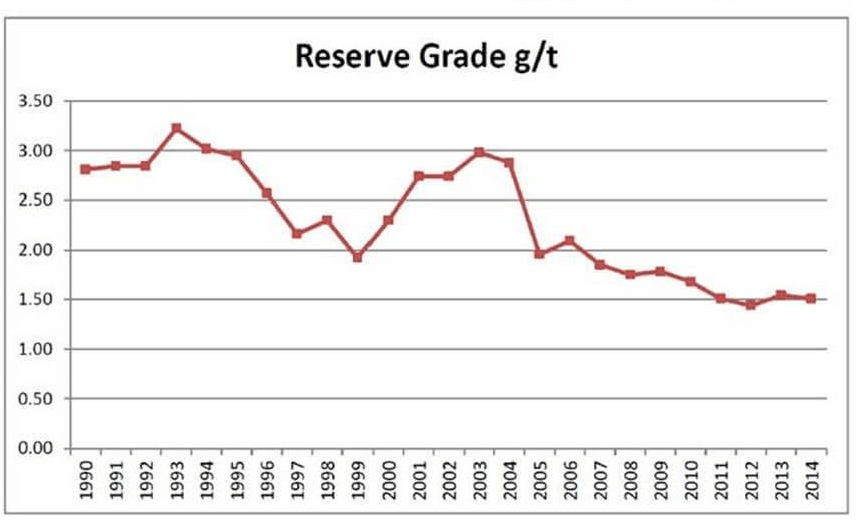

What makes Gold “Precious” is the fact it is tough to find mines that will sustainably deliver returns. If this weren’t the case then it wouldn’t be precious at all. Check out the 25 year chart below for global miners reserve grade. With gold prices rising from under $300/oz in 2002, you would think the billions of dollars pouring into exploration and development since then would have translated into higher quality mines… but clearly this hasn’t been the case. Reserve grades are down to 1.50 gpt on average. Global gold production has already peaked in the 95Mozs per year – this is likely to move to ~85Mozs within 5 years. Scotia Mining Sales (via discussions with industry experts at our January commodities conference) believes that for every ~6.5Mozs (or 100t) uptick in gold demand or 6.5Mozs downtick in gold supply roughly translates to a gold price move in the $100/oz range. But higher gold prices doesn’t necessarily translate to higher sustainable gold supply as we have just witnessed.

The point above as an investor is – gold developers with average gold resource / reserve grades above 1.50 gpt are special and are likely takeover targets. Large cap gold producers have recently signalled they are more inclined to take toe-holds in prospective junior companies rather than run large greenfield exploration programs. Many CEOs looking back over the past decade have noted they have spent $100’s of millions on exploration and have little to show for it right now. Of course a 1.5 gpt number is not gospel….as an example, Scotia Mining Sales would love to uncover a 5Moz, 0.8 gpt, open-pittable, low strip, gold oxide heap leach with high recoveries and fast leach kinetics.

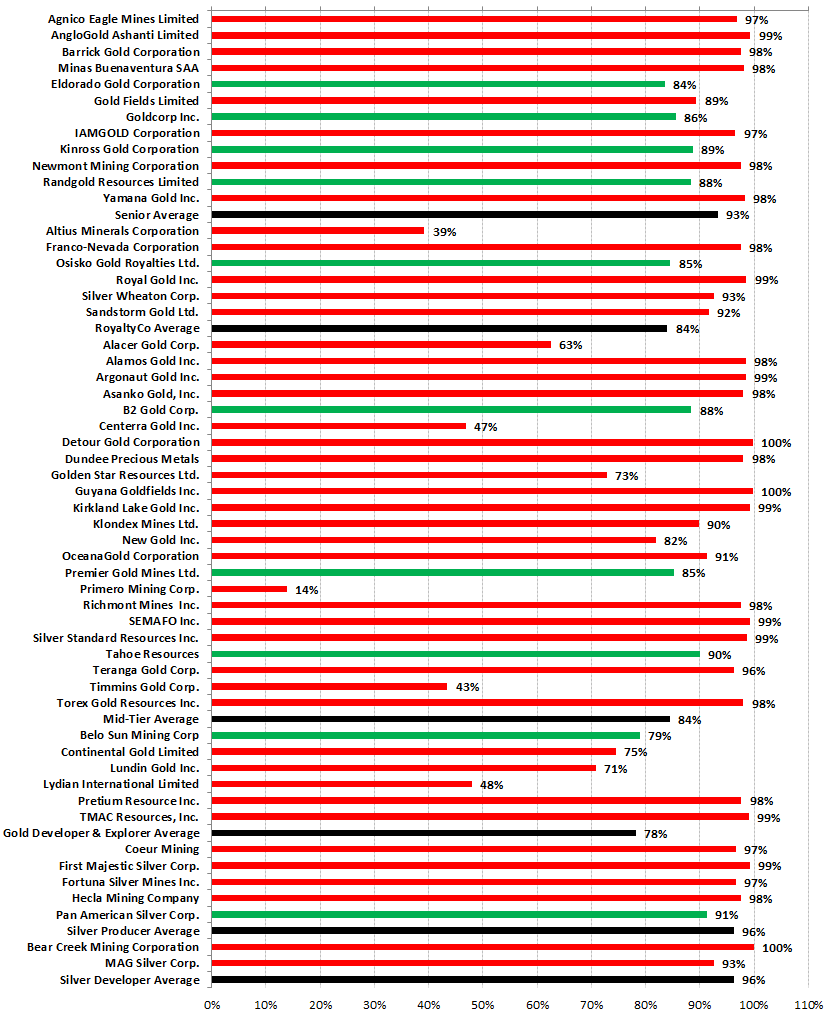

Who is Special? What Are The Projects/Companies with Reserve Grades Above 1.5 gpt …

Best Gold Mine Developers:

- Lundin Gold – Fruta del Norte

- MAG Silver – Juanicipio (gold-eq)

- TMAC Resource – Hope Bay

- Premier Gold – Hardrock

- Pretium – Brucejack

- Continental Gold – Buritica

- Dalradian – Curraghinalt gold deposit

- Sabina Gold & Silver – Back River Property

Newbie Producers:

- Torex Gold – ELG & Media Luna

- Guyana Gold

- Asanko – Asanko Gold Project

And a few larger cap producers with some sizeable projects:

- Kinross – Tasiast

- Agnico-Eagle – Amaruq, Meliadine

- Barrick – Goldrush

- Yamana – Cerro Moro

- Newmont – Long Canyon

- B2Gold – Fekola

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

This article expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.