How do you measure the value of gold a gold deposit still in the ground in terms of a company that is mining or in production exploration stage?

The starting premise is how we value advanced explorers and developers to target companies that are undervalued with respect to their peers and evaluate how viable they’re as stakeholders.

We use peer evaluations, some do it a little a little differently than others in being much more technically oriented and numbers oriented. Some others tend to fly by the seat of their pant when it comes to these things, but the bottom line is that the value of an ounce in the ground or the value of a company is equal to the quantity of ounces in the ground, times of the price that it’s valued at.

Some approach the problem in somewhat different ways but we’re really looking for undervalued companies at any time in their history for speculation.

Some geologist look at your structure, people, project and cash in hand, so it all goes together but really the project is keen and a lot of analysts will tell you that management is the most important part of any Gold company, explore developer. That is BS as the project is king no matter how good management is, as never have we seen a Gold explorer developer, mining taking over because of the attributes of its management. It’s really about the project and its mining equipment.

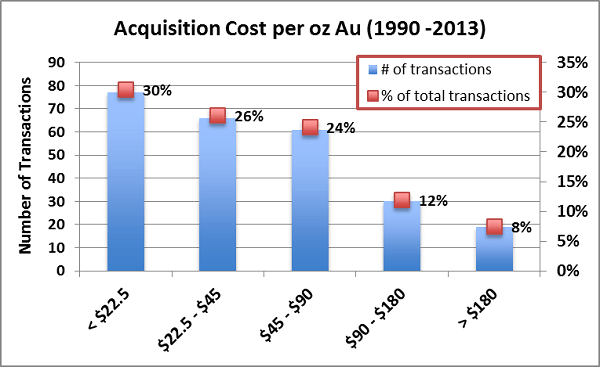

During a period from 1992-2013, so that goes from a bear market to bull market, to a bear market and to a bull market again, so really two cycles and they looked at the number of ounces in the ground on all these projects and evaluated the costs paid per ounce and they were able to show that 80% of the acquisitions occurred less than $90/ounce of Gold in the ground and 60 excuse me, 56% of those occurred at less than $45 an ounce in the ground, so that kind of gives you a upper limits on what the peer valuations should be, Surprisingly they found that the stage of the project did not correlate with the cost paid for it, so whether it was in production of miner pre-production development, feasibility stage, there was no correlation, also very surprisingly and perhaps even more astounding to me was the size of the deposits does not matter, so deposits with a hundred thousand ounces would be valued equally with projects with thirty million ounces in some cases, so there appears to be a standard that the industry is willing to pay, now there are outliers, we see some very bad acquisitions paid for it, very high cost per ounce especially during the bull market, but anyway that kind of gave the big shoppers an upper limit for a pure evaluation.

How can we use this model to our advantage to measure value especially in a market like this, you know how does the Gold price come into play when you value these ounces in the ground?

Historically, some use a rule were about 10% of the gold price would be the value, the highest value put on in the ground ounces, but it should also be mentioned that not all ounces are created equal, so you have resources, major indicated and inferred with higher levels of competence from major as opposed to inferred which don’t really have very much competence in it and then you have reserves, proven and probable reserves where there been a feasibility or pre-feasibility study done and those ounces are shown, have been shown to be economically minable at that particular time.

So what you want to do is take a look at the quality of the ounces, and that quality of the ounces really keen, you want high margin ounces, what the studies show was a couple of examples as that the engineering studies are often done and also the preliminary economic assessment, pre-feasibility studies, feasibility studies. The takeover prices are often much lower than the value put on those.

The conclusion really became that when you’re ally investor you need to listen to people without a vested interest in the project or real valuations, things tend to be valued very high and then you want to look at the valuation at any time with respect to its peers, if you find companies they’re so undervalued with good projects and those become entry point and then you have existed points when that company is fully valued using the efficient market hypothesis

https://news.goldseek.com/GoldSeek/1433275200.php

With this model, you know the conclusion really, you know you look at 253 take over a lot of it majority at $90 per ounce and the partial to $45 per ounce. Around 56% is that corrected?

It looks like basic on this model unless you’re there early into the story, that’s really where you get the highest return on investment and those are the type of companies you have to look out for.

What the study really show was time and time again that the early on investors the founders, the family and friends, private placements that early on the financing and the price early on would give an opportunity for entry, however, you want to be very careful as these things progressed through engineering studies because over and over again we found out they were fully or overvalued.

With private placements done at much higher prices than takeover price and that, and what you really need to do is as ally investor we found too many times those people were left holding the bag and this should encourage people to do these types of peer evaluation. One of the differences between the pros and the others is some do back of the envelope stuff and I’m dependent on the engineers and other analysts to crunch the numbers for me but you can buy an undervalued company at any time and those are the ones you want to get into with the ability for takeovers or also entry and exit points as they become fully valued.